So, you're ready to dive into competitor analysis. Let's be clear: this isn't about spying on your rivals or just copying their latest moves. It's a systematic way of researching the key players in your space to figure out their strengths, weaknesses, and overall game plan.

Essentially, you're gathering intelligence to find opportunities for your own business to shine.

What Is Competitor Analysis Really About?

Before you start digging through websites and social media feeds, it's crucial to understand the real goal here. This isn't just about mimicry. Think of it as a strategic investigation into your entire market so you can carve out a unique, defensible spot for your brand.

It’s like creating a detailed map of your business terrain. A solid analysis guides huge decisions across your company, from product development and pricing to the very words you use in your marketing. When you understand what’s working for others—and, just as importantly, what isn't—you can sidestep their mistakes and jump on the market gaps they’ve overlooked. For a deeper dive, this ultimate guide to competitor analysis is a great resource.

Uncovering Different Types of Competitors

Your competition isn't always who you think. To get the full picture, you need to identify and sort them into a few key categories. Skipping this step can create massive blind spots, leaving you vulnerable to a rival you never saw coming.

Generally, you'll encounter three types:

- Direct Competitors: These are the obvious ones. They sell a nearly identical product or service to the exact same audience. Think McDonald's vs. Burger King.

- Indirect Competitors: These businesses solve the same core customer problem but with a totally different solution. A local pizza shop and a meal-kit service like HelloFresh are indirect competitors—both are solving the "what's for dinner?" dilemma.

- Emerging Competitors: Also known as replacement or tertiary competitors, these are newcomers or adjacent businesses that could easily pivot into your market. That new vegan café might not seem like a threat to a traditional coffee shop, until it starts heavily promoting its specialty coffee menu.

To help you get started, here’s a quick way to think about where to focus your energy first.

Types of Competitors and Where to Focus

This table is a quick reference guide to help you categorize competitors and focus your initial research efforts effectively.

| Competitor Type | Definition | Primary Focus for Analysis |

|---|---|---|

| Direct | Offers a very similar product/service to the same target audience. | Pricing, feature set, marketing messaging, customer reviews. |

| Indirect | Solves the same core problem with a different solution. | Marketing angles, value proposition, customer acquisition channels. |

| Emerging | New entrants or companies that could pivot to become direct rivals. | Funding, unique technology, early market traction, team expertise. |

By identifying who fits into each category, you avoid tunnel vision and build a more complete view of the market.

Understanding these distinctions is foundational. The global Competitor Analysis Evaluation market was valued at $4.32 billion in 2021 and is expected to climb to $6.6 billion by 2025, which shows just how critical this process has become.

By looking beyond just direct rivals, you gain a 360-degree view of the forces shaping customer choices. This broader perspective is where true strategic opportunities are often found, allowing you to innovate rather than just imitate.

In the end, a well-run competitor analysis gives you the clarity to make smarter, faster decisions. It shifts your strategy from reactive to proactive, ensuring your business and marketing efforts are built on a solid foundation of evidence. For any startup or SME, this isn't just a nice-to-have—it's a critical tool for survival and growth.

Identifying Who You Are Truly Competing Against

Before you can even think about outsmarting the competition, you need a brutally honest picture of who you're actually up against. It’s all too easy to fixate on the one or two big names in your space, but that kind of tunnel vision can create massive blind spots in your strategy.

The truth is, your competitive landscape is almost always bigger and messier than you think.

First, you have to look past the obvious players. Your most immediate rivals are your direct competitors—the companies offering a nearly identical product to the exact same customer. But then you have the indirect competitors, who solve the same core problem your customers have, just in a completely different way.

Think about a project management tool. It’s not just competing with other software. It’s also competing with a simple spreadsheet, a physical wall planner, or even a custom-coded internal system someone’s IT department threw together. Getting a handle on this is the first real step, so it’s worth learning how to identify competitors effectively.

Digging Deeper with Keywords and Customer Feedback

One of the most powerful ways to uncover these hidden competitors is by looking at what’s happening on search engines. What companies are consistently showing up for the keywords and phrases your ideal customers are typing into Google? SEO tools are an absolute goldmine here.

Take a look at this screenshot from Semrush, which analyzes the keyword "small business accounting software."

This single search reveals so much more than just direct software rivals. You can instantly see major publications, review sites, and affiliate marketers who are all fighting for your audience's attention. These aren’t just distractions; they are key players in your ecosystem you need to understand.

Another fantastic source of intel? Your own customers.

Pay close attention during sales calls and in support tickets. What other tools or companies do prospects and customers mention? Their language often points directly to the alternatives they were weighing up before they found you.

Creating Your Competitor Tiers

Once you've got a list brewing, the next step is to organize it. Don't just stare at a long, intimidating list of names. Group them into tiers to bring some much-needed focus to your analysis.

Tier 1: Primary Competitors

These are your direct rivals. Same audience, similar product, same business model. You should be watching their every move, and watching it often.Tier 2: Secondary Competitors

This bucket is for indirect competitors or companies that target a slightly different slice of the market. Maybe they offer a high-end enterprise version of a solution that’s similar to your SME-focused product.Tier 3: Tertiary Competitors

Think of these as the ones on the horizon. They could be emerging startups, businesses in adjacent markets, or potential future threats. They might not be a concern today, but a strategic pivot could make them a Tier 1 competitor tomorrow.

By mapping out your competition this way, you create a complete picture of the market. This isn’t just an academic exercise—it prevents you from getting blindsided and ensures the analysis you’re about to do is built on a solid, accurate foundation.

How to Gather Actionable Competitive Intelligence

Alright, you’ve mapped out who you’re up against. Now it's time to switch gears from simple identification to a full-blown investigation. The goal here isn't just to pile up random data points. We're looking for focused, actionable intelligence that peels back the layers of your competitors' strategies.

This means we need to move beyond just looking at their homepage. A proper competitor analysis requires a systematic approach to ethically deconstruct their marketing funnels, see their pricing models in action, and understand their content strategies and what customers really think about them.

Building Your Intelligence Toolkit

First things first, you need the right tools for the job. There's no single magic platform that does it all, so think of this as assembling your own digital detective kit. A smart combination of specialized software will give you that crucial 360-degree view, with each tool designed to uncover a specific piece of the puzzle.

Here are the essential categories you'll want to cover:

- SEO and Content Analysis: Tools like Ahrefs or Semrush are non-negotiable. They show you the exact keywords a competitor is ranking for, their best-performing content, and—most importantly—their backlink profile, which reveals who is endorsing them online.

- Social Media Listening: Forget follower counts. Platforms like Brandwatch or Hootsuite track brand mentions, analyze sentiment, and map out engagement patterns. This tells you how the public actually feels about a competitor's products and campaigns.

- Website and Ad Intelligence: Using a tool like Similarweb lets you estimate website traffic, pinpoint referral sources, and even get a peek at their paid advertising strategies. This helps you figure out which digital marketing channels are actually driving their growth.

To give you a clearer picture, I've put together a quick-reference table of the kinds of tools you'll need and what to look for with each one.

Your Competitor Data Collection Toolkit

| Data Category | Recommended Tool(s) | Key Metrics to Track |

|---|---|---|

| SEO Performance | Ahrefs, Semrush, Moz | Organic keywords, Top ranking pages, Domain Authority, Backlink profile |

| Content Strategy | BuzzSumo, Ahrefs | Most shared content, Content formats (blog, video, etc.), Publishing frequency |

| Social Media Presence | Brandwatch, Hootsuite | Engagement rates, Follower growth, Sentiment analysis, Top performing posts |

| Paid Advertising | Similarweb, SpyFu | Ad spend estimates, Ad copy & creatives, Top paid keywords, Landing pages |

| Website Traffic | Similarweb, Alexa | Monthly visits, Traffic sources (direct, search, social), Bounce rate, Avg. session duration |

| Customer Reviews | G2, Capterra, Trustpilot | Overall rating, Common complaints, Praised features, Customer service mentions |

This toolkit isn't about buying every subscription you can find. It's about strategically choosing a few key platforms that give you reliable data across the most important areas of your competitors' businesses.

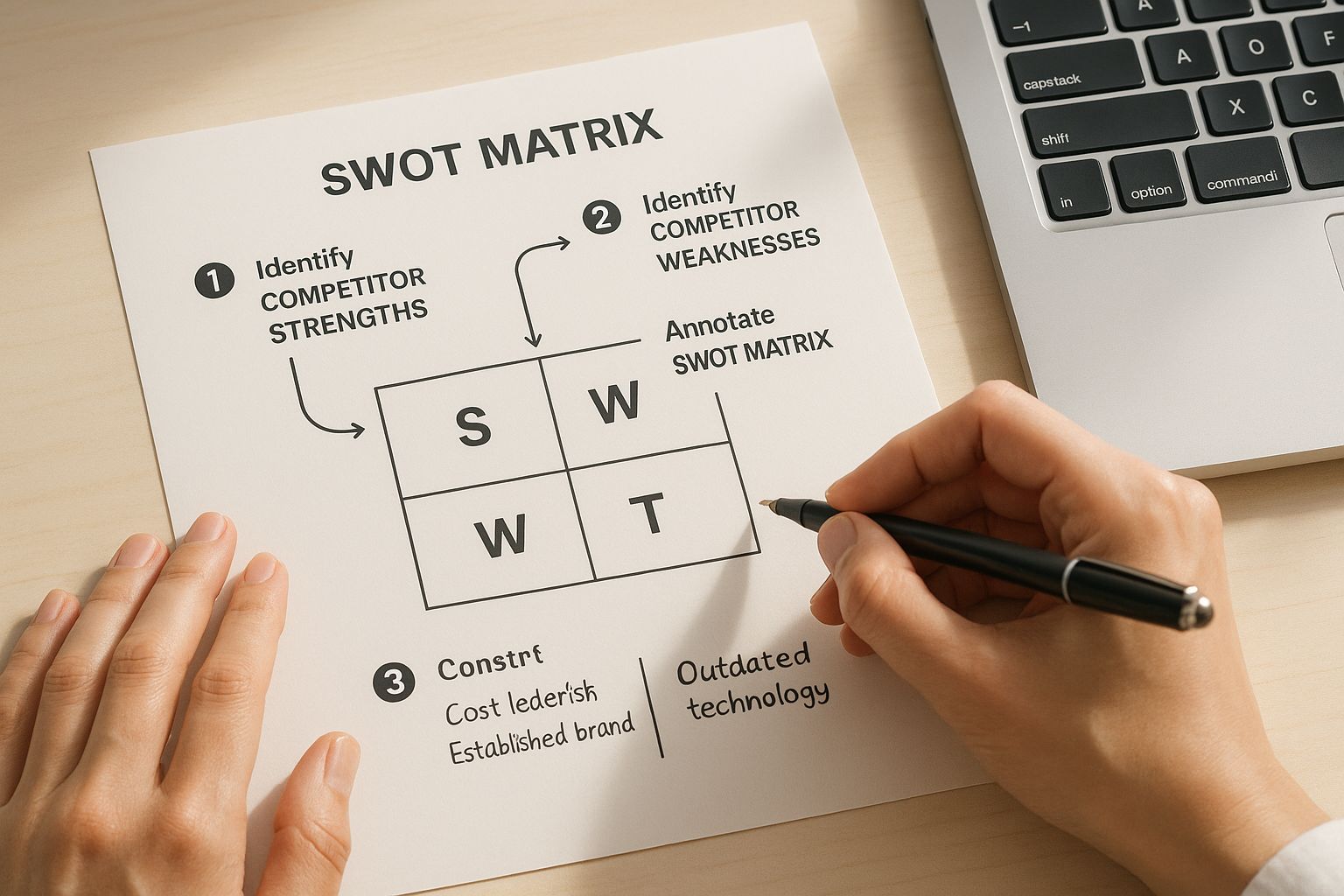

This infographic breaks down a structured way to organize the intelligence you gather, helping you move from raw data to a clear SWOT analysis.

When you methodically plot out their strengths and weaknesses like this, you create a visual map of market opportunities and threats. It’s a game-changer.

Key Data Points to Collect

To avoid getting buried in data, stay laser-focused on a specific checklist of intelligence. Your mission is to gather intel that directly informs your strategic decisions, from product development to your marketing copy.

For each of your main competitors, start by zeroing in on these critical areas:

- Product and Pricing: Get the details. Document their core features, map out their different pricing tiers, and identify their unique selling propositions. Don't be shy—sign up for their free trials or book a demo to experience their user onboarding firsthand.

- Content and SEO Strategy: Figure out their main content pillars. Are they all-in on blogs, videos, or webinars? What keywords are they consistently targeting? For a deep dive into SEO, learning how to master competitor rank tracking can give you direct, real-time insights into their search visibility.

- Customer Experience and Reviews: Dive into sites like G2, Capterra, and Trustpilot. You're looking for patterns. Are customers always complaining about the same bug? That’s a weakness. Do they consistently praise the customer support? That's a strength you need to be aware of.

Collecting data is just step one. The real magic happens when you synthesize all this information to spot patterns, identify gaps in the market, and find the cracks in a competitor's armor. Those cracks are your greatest opportunities.

By structuring your intelligence gathering this way, you're not just creating a dossier of facts. You're building a strategic foundation that will empower you to make smarter, evidence-based decisions in the next stage of your analysis.

Analyzing Competitor Strengths and Weaknesses

You’ve done the legwork and gathered a ton of competitive intelligence. Great. Now you’re probably staring at a mountain of raw data—spreadsheets, reports, screenshots, you name it. This is where the real magic happens. It’s time to turn that pile of disconnected facts into a clear, actionable map of your competitive landscape.

The goal here is to move beyond just listing a competitor's features or tallying up their follower count. You need to connect the dots and figure out where they’re genuinely strong and, more importantly, where they’re vulnerable.

A classic way to frame this is with a SWOT analysis, which forces you to look at a competitor's Strengths, Weaknesses, Opportunities, and Threats. If you want to dive deeper into the framework itself, Statista has a solid overview. It’s a simple but powerful method for understanding why certain competitors succeed while others stumble.

For instance, maybe a rival has a brilliant, user-friendly app (strength), but their customer support is notoriously slow and unhelpful (weakness). That’s not just a minor issue for them; it’s a critical opening for you.

Moving Beyond a Basic SWOT

A SWOT is a fantastic starting point, but to get insights that actually drive strategy, you have to dig deeper. Let’s break down the analysis into specific business areas to create a much more detailed and useful comparison.

Imagine a new direct-to-consumer (DTC) sustainable sneaker brand trying to size up a legacy footwear giant.

- Product and Value Proposition: The big retailer has a massive selection—that’s a clear strength. But look closer, and you'll see many of their products lack any real sustainability story. That’s a glaring weakness. Your DTC brand might have a smaller product line, but you can completely own the eco-friendly narrative.

- Customer Experience: The established player has hundreds of physical stores, making returns a breeze (strength). On the flip side, their online checkout is clunky, and their social media presence feels generic and corporate (weakness).

- Marketing and Branding: The legacy brand has a colossal advertising budget (strength), but their messaging is so broad it tries to appeal to everyone and ends up resonating with no one. This creates a perfect opportunity for your brand to connect with a niche audience that craves authenticity and a mission they can believe in.

By systematically stacking yourself up against the competition across these pillars, you move from a vague "they're big" to a precise, evidence-based understanding of where you can build a genuine advantage.

Identifying Market Gaps and Opportunities

As you start laying out these comparisons, patterns will emerge. These patterns almost always point directly to untapped market gaps or underserved customer groups.

You should be actively looking for the "buts" in your analysis—those areas where a competitor's strength is directly tied to a weakness.

For example, a competitor’s rock-bottom prices (strength) might only be possible because they use cheaper materials and offer nonexistent customer service (weakness). This isn't just a flaw; it's a strategic trade-off they've consciously made. And it creates a clear opening in the market for a brand that offers a higher-quality product with exceptional support, even if it comes at a premium price.

Your end goal is to build a scorecard for each of your main competitors. Grade them on each pillar and compare that grade to your own. This benchmarking process doesn't just show you who’s winning; it shows you how they’re winning—and exactly what it would take for you to change the game. The weaknesses you find aren't just for internal notes; they are the strategic openings you’ll exploit in the final stage of your plan.

Turning Your Insights Into Strategic Action

An analysis left to gather dust in a spreadsheet is a wasted opportunity. The whole point of this exercise is to turn your hard-won insights into decisive, forward-moving action. This is where your research stops being theoretical and starts building a real-world competitive advantage.

The goal is to draw a straight line from what you’ve learned to your business objectives. Don't just admire the data; challenge it. You need to ask, "So what?" for every single finding. If you discovered a top competitor’s website is slow and clunky, your action isn't just to "have a faster website." It’s to launch a marketing campaign that hammers home your superior user experience.

From Findings To Framework

It's easy to get overwhelmed by a long list of potential actions. That's why you need a simple framework to prioritize your next steps. Let’s be honest, not all actions are created equal. Some offer a massive return for minimal effort, while others are resource-draining projects with a less certain payoff.

A great way to visualize this is with an Impact/Effort Matrix. This simple tool helps you sort every potential action into one of four buckets:

- Quick Wins (High Impact, Low Effort): These are your immediate priorities. For example, rewriting your website’s value proposition to directly counter a competitor's biggest weakness.

- Major Projects (High Impact, High Effort): Think of these as your big strategic initiatives. This might be developing a whole new product feature that fills a major market gap you've identified.

- Fill-Ins (Low Impact, Low Effort): These are smaller tasks to tackle when you have the time. Optimizing a few blog post titles or tweaking social media bios falls into this category.

- Reconsider (Low Impact, High Effort): These are the ideas you should probably shelve for now. They simply require too many resources for too little gain.

Using a matrix like this prevents "analysis paralysis" and gets your team focused on what actually matters. It transforms a jumbled list of ideas into a clear, sequenced action plan.

Your competitor analysis shouldn't be a one-time report. It has to become a living strategy that continually informs your decisions—from big product roadmap changes to subtle shifts in your marketing copy.

Building a Sustainable Advantage

Once you've prioritized your actions, it's time to weave them into your everyday workflows.

For instance, if your findings reveal a competitor’s messy supply chain, that could inform your next big push in operational efficiency—a process often managed with robust ERP software. If you find they consistently drop the ball on customer service, you can double down and make exceptional support a cornerstone of your brand identity.

This ongoing process constantly refines your value proposition, sharpens your marketing, and carves out a defensible space in the market. By consistently turning insights into action, you stop reacting to rivals and start proactively setting the pace. This is how a thorough competitor analysis becomes a powerful engine for sustainable growth.

Common Competitor Analysis Questions

When you're deep in the weeds of a competitor analysis, questions are bound to pop up, even with a solid plan. It happens to everyone. Let's walk through some of the most common ones I hear to clear things up as you dig into this work.

How Often Should I Run This Analysis?

This is a big one, and the honest-to-goodness answer is: it really depends on your industry.

For a full-blown, comprehensive deep dive, aim for semi-annually or annually. This gives you a solid benchmark and helps you spot those slow-moving, long-term strategic shifts your competitors are making. Think of it as your yearly physical for market positioning.

But you can't just set it and forget it. For your top three to five direct competitors—the ones who keep you up at night—you should be doing a lighter, monthly check-in. This is more of an ongoing pulse check to catch things like:

- New product launches

- Significant pricing changes

- Major marketing campaigns

This way, you're never caught flat-footed. If you're in a fast-moving space like e-commerce or tech, I'd even recommend a more thorough quarterly refresh. You have to move at the speed of the market.

What Are the Biggest Mistakes to Avoid?

I've seen businesses make the same few missteps time and time again when they're learning how to analyze competitors. Just knowing what they are is half the battle.

- Tunnel Vision: This is a classic. You get so focused on your main, direct competitors that you completely miss the new startup or the company from an adjacent industry that's about to eat your lunch.

- Aimless Data Collection: You gather mountains of data without a clear "why." This just leads to "analysis paralysis," where you're drowning in information but have zero actionable insights.

- The Copycat Strategy: Don't just mimic what your competitors are doing. The goal isn't to become a slightly different version of them; it's to find your own unique angle.

- The "One-and-Done" Mentality: This isn't a school project you turn in and forget. Think of competitor analysis as a living, breathing process that continuously feeds your strategy.

The single biggest mistake is using competitor analysis to play catch-up. Its real power is in proactively finding the gaps in the market—the underserved customer needs that your brand is perfectly positioned to solve.

Is This the Same as Market Research?

It's a common point of confusion, but they're definitely not the same thing. They're related, but distinct.

Think of market research as the 10,000-foot view. It’s about understanding the entire landscape: customer needs, industry trends, and the total size of the market. It's broad.

Competitor analysis is a crucial piece of that puzzle, but it zooms in on one specific area: your rivals.

Here's a simple way to look at it: market research tells you what customers want, while competitor analysis shows you how other companies are trying to give it to them. You absolutely need both to build a strategy that wins.

Ready to turn your competitive insights into a digital presence that actually performs? KP Infotech specializes in web development, enterprise software, and marketing strategies that give you a real edge. Let's build something that makes your competitors nervous. Learn more about our services.